kentucky income tax calculator

Property taxes in Kentucky follow a one-year cycle beginning on Jan. Kentucky imposes a flat income tax of 5.

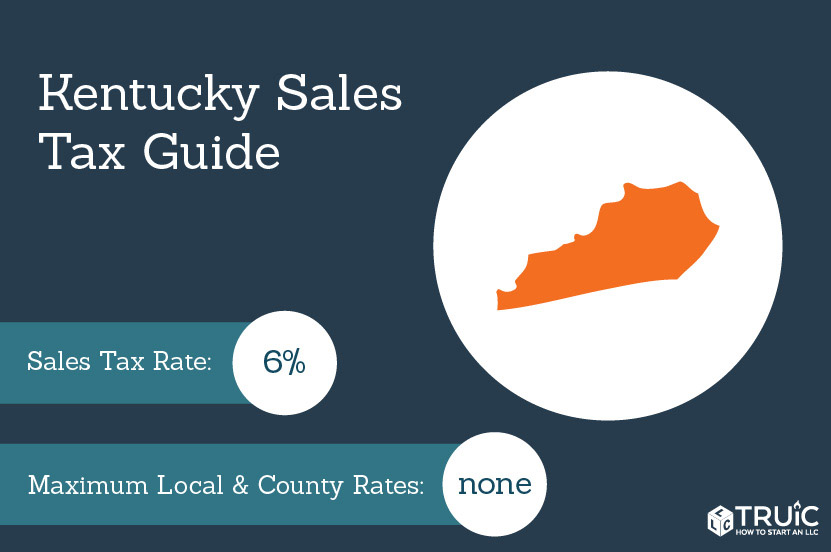

Kentucky Sales Tax Calculator And Local Rates 2021 Wise

This income tax calculator can help estimate your average.

. This tool was created by 1984 network. The 2022 state personal income tax brackets. The Kentucky tax calculator is updated for the 202223 tax year.

Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. After a few seconds you will be provided with a full breakdown. So the tax year 2022 will start from July 01 2021 to June 30 2022.

The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income. Kentucky Salary Paycheck Calculator. Kentucky is one of the states that underwent a tax revolution in 2018 making its tax rates much easier to follow and learnSince 2018 the state has charged taxpayers with a flat income tax.

These types of capital gains are taxed at 28 28. 2022 tax rates for federal state and local. Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. Kentucky is one of these states. Overview of Kentucky Taxes.

This calculator assumes that none of your long-term capital gains come from collectibles section 1202 gains or un-recaptured 1250 gains. 1 of each year. The tax rate is the same no matter what filing status you use.

Your average tax rate is 1198 and your marginal. Kentuckys individual income tax law is based on the Internal Revenue Code in effect as of December 31 2018. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

The Department of Revenue has developed an downloadable Excel-based calculator for the new inventory tax credit. Kentucky State Income Tax Calculator In the United States there are nine states that have a flat income tax. If you would like to help us out donate a little Ether cryptocurrency to.

The bracket threshold varies for single or joint. Kentucky Property Tax Rules. The tax rate is five 5 percent and allows itemized deductions and certain.

The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Kentucky State. The KY Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for. Before the official 2022 Kentucky income tax rates are released provisional 2022 tax rates are based on Kentuckys 2021 income tax brackets.

Kentucky Income Tax Calculator 2021. We encourage all taxpayers and preparers to utilize this useful tool. Calculate your net income after taxes in Kentucky.

25000 income Single with no children - tax 1136 35000 income Single parent with one child - tax 1676 50000 income Married with one child - tax. If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. Select an Income Estimate.

Kentucky Income Tax Calculator Calculate your federal Kentucky income taxes Updated for 2022 tax year on Aug 31 2022. Just enter the wages tax withholdings and other information required. Aside from state and federal taxes many Kentucky.

Thats the assessment date for all property in the state so.

/cloudfront-us-east-1.images.arcpublishing.com/gray/6KYG4BVL7NOYZCXOJDV32TWJ2Q.jpg)

Kentucky Senate Passes Income Tax Rebate Measure

Dual Tax Status What Does It Mean For Your Pastor American Church Group Kentucky

The Kentucky Cpa Journal Tax In The Bluegrass Issue 1 2021 Kentucky Society Of Certified Public Accountants

![]()

Income Tax Calculator 2022 Usa Salary After Tax

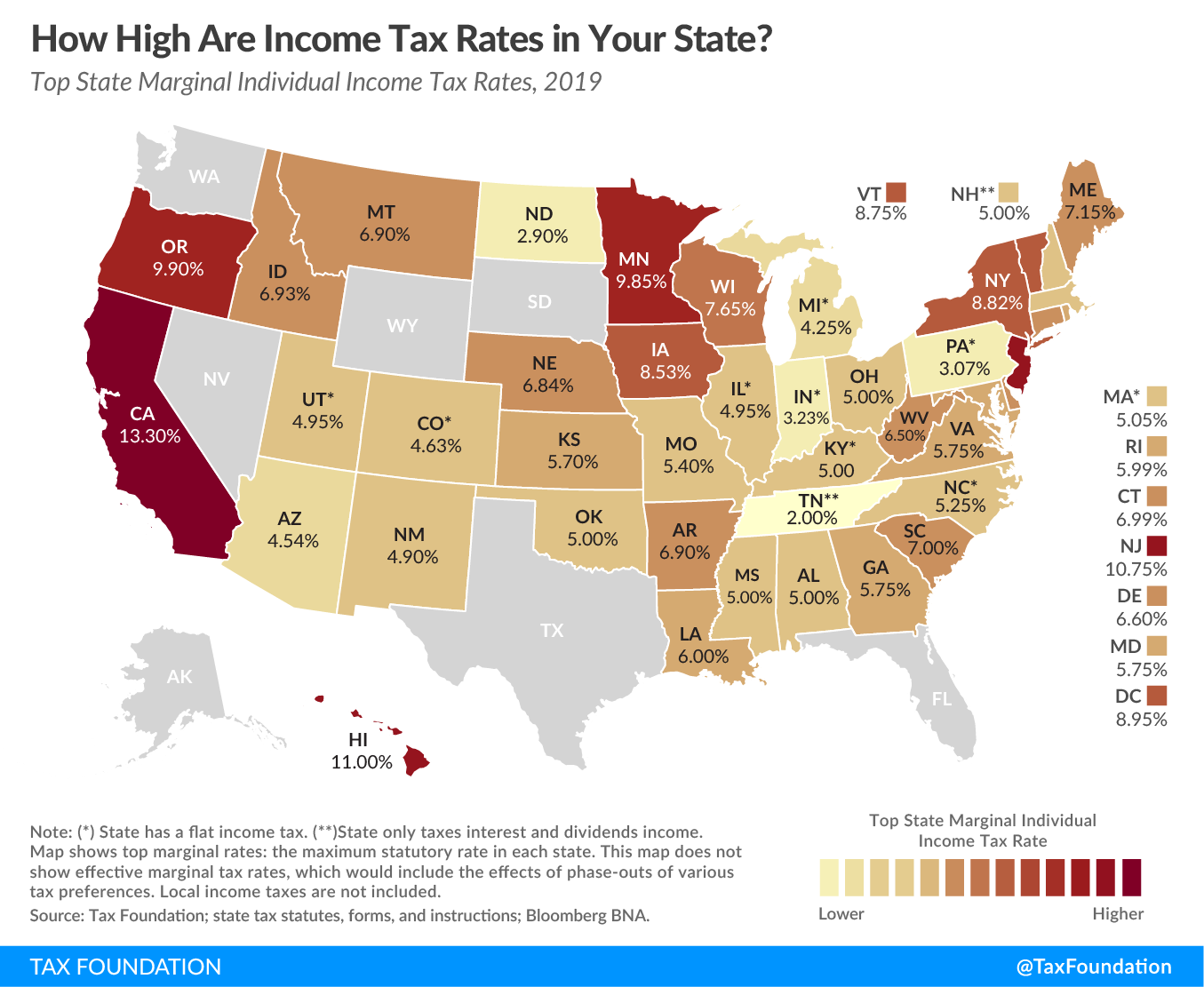

State Individual Income Tax Rates And Brackets Tax Foundation

Tax Withholding For Pensions And Social Security Sensible Money

Car Tax By State Usa Manual Car Sales Tax Calculator

Kentucky House Republicans Offer Tax Reform Bill That Could Eliminate Personal Income Taxes Kentucky Thecentersquare Com

Capital Gains Tax Calculator Estimate What You Ll Owe

2022 Federal State Payroll Tax Rates For Employers

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Kentucky Sales Tax Small Business Guide Truic

Individual Income Tax Department Of Revenue

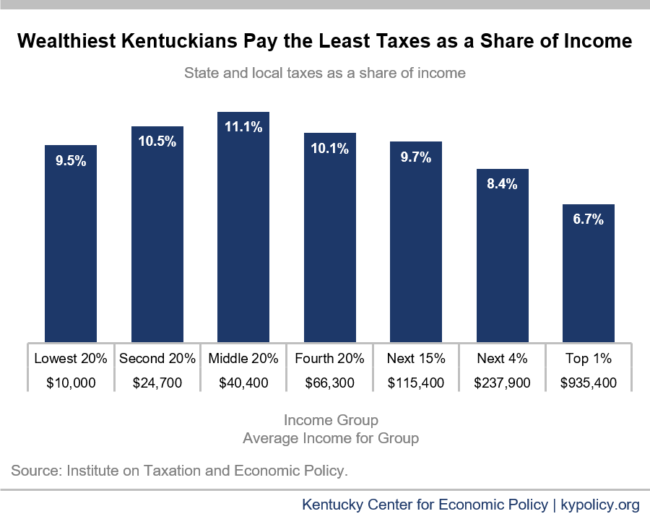

New Report Wealthiest Kentuckians Pay The Lowest Tax Rate And The Problem Is Worsening Kentucky Center For Economic Policy

Kentucky Municipality Taxes Is There A Way To Simplify Inscipher

Mortgage Calculator Kentucky New American Funding

Tax Withholding For Pensions And Social Security Sensible Money